Someone driving an AutoZone delivery truck pulled out in front of me and I wrecked my brand new truck. When I say brand new I mean I had it for 2 weeks at it had around 700 miles on it. My question is, what can I do to make sure I don't get screwed by the insurance agency? The other driver was at fault and I haven't talked to their insurance people yet.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

NonDawg Car Accident Advice

- Thread starter Darth Dawg

- Start date

Do you have gap insurance? If you do, there is no worries. If the company the other person is insured with low balls you iyo, check prices of that exact car(match features)for sale within a 60 mile radius. Put together a list of the ones selling for more than they are offering. There a lot more questions to ask here. But this is the simplest method to fight back. Just hope autozone isn’t self insured. That can be a nightmare. Don’t threaten to call an attorney. It doesn’t mean you can’t call one. But autozone will cut off the conversation if you threaten this. It is good to have proper advice, but going to court takes time and doesn’t help you get a replacement vehicle any faster. If you are hurt, different story. Call @NWGA_DAWGSomeone driving an AutoZone delivery truck pulled out in front of me and I wrecked my brand new truck. When I say brand new I mean I had it for 2 weeks at it had around 700 miles on it. My question is, what can I do to make sure I don't get screwed by the insurance agency? The other driver was at fault and I haven't talked to their insurance people yet.

Last edited:

Someone driving an AutoZone delivery truck pulled out in front of me and I wrecked my brand new truck. When I say brand new I mean I had it for 2 weeks at it had around 700 miles on it. My question is, what can I do to make sure I don't get screwed by the insurance agency? The other driver was at fault and I haven't talked to their insurance people yet.

Since this was a corporation they 99.9% have correct and the proper amount of coverage. So that’s good news. Your aren’t dealing with “the minimum required”.

You also need to know exactly what you want from all this. That way you get a fair offer.

And as always....document everything!

Call @NWGA_DAWGSomeone driving an AutoZone delivery truck pulled out in front of me and I wrecked my brand new truck. When I say brand new I mean I had it for 2 weeks at it had around 700 miles on it. My question is, what can I do to make sure I don't get screwed by the insurance agency? The other driver was at fault and I haven't talked to their insurance people yet.

this is not a do it yourself thing OP. You’re going to get ferked if you try to handle on your own.

You’re going to get a lot of advice from dudes in this thread who aren’t lawyers. Their advice is wrong. Call an attorney today.

Is it repairable? If “yes” you can claim depreciation loss of future value even if it’s purely cosmetic damage. Any debate will be what the insurance company says your PU is worth after repair v what it was pre-accident v what you paid for it. Been through four similar situations and personally I’d wait to see what their settlement offer is first before opening a can. It sux, bro.Someone driving an AutoZone delivery truck pulled out in front of me and I wrecked my brand new truck. When I say brand new I mean I had it for 2 weeks at it had around 700 miles on it. My question is, what can I do to make sure I don't get screwed by the insurance agency? The other driver was at fault and I haven't talked to their insurance people yet.

Last edited:

Also, as someone who defends insurance companies for a living, DO NOT CALL THEIR INSURANCE COMPANY. They’re not your friend and they will steamroll you if you don’t have counsel.

1) If you bought and have Gap insurance you will be fine.

2) If you leased and have Gap insurance through your insurer or the lessor you will be fine.

So I hope you have Gap insurance. Otherwise, you might have to pursue a legal claim against AutoZone to cover the gap.

2) If you leased and have Gap insurance through your insurer or the lessor you will be fine.

So I hope you have Gap insurance. Otherwise, you might have to pursue a legal claim against AutoZone to cover the gap.

Yes. If he is hurt. Call a lawyer for sure. If he isn’t hurt no lawyer is taking a case on whether he gets a proper settlement on his car value. But don’t tell autozone he has called a lawyer at all. The conversation is over at that point. Just sayin. Meant for @donalsonville_dawg sorrySince this was a corporation they 99.9% have correct and the proper amount of coverage. So that’s good news. Your aren’t dealing with “the minimum required”.

You also need to know exactly what you want from all this. That way you get a fair offer.

And as always....document everything!

I don’t think so, but I haven’t heard anything official yet.Is it repairable?

Call @NWGA_DAWG

this is not a do it yourself thing OP. You’re going to get ferked if you try to handle on your own.

You’re going to get a lot of advice from dudes in this thread who aren’t lawyers. Their advice is wrong. Call an attorney today.

Thanks and happy to help @Darth Dawg

Get confirmation its totalled and you get blue book retail for it. if not start complaining about your neck.

Sorry about your accident! I fully agree with donalsonvilledawg about not doing this on your own. It is much easier if the truck is totaled, which is hopefully the case. Since it was brand new, the replacement cost would be determined by the cost of a another new truck. If it is heavily damaged, it is more problematic. The insurance company would cover the full cost of repairs and a rental vehicle during the repair process. The problem is you are then faced with making a diminution in value claim against the insurance company. This is extremely significant because your truck will never be as valuable with the damage from the accident. Whenever you sell or trade in your truck, you will get substantially less than actual value. Any Carfax or Auto check report will show the damage. The best approach for a diminution in value claim is to obtain an appraisal from a certified vehicle appraiser who will write a full report about the damage, repairs, and the reduction in value that resulted.

Were you hurt?I don’t think so, but I haven’t heard anything official yet.

If you have good insurance, file under yours and let them subrogate. Just will be responsible for your deductible if you do.

Yes. There is a formula for diminished value out there. Just google it. If you don’t understand it, dm me. I will help you. This is only if they decide to repair it. If they total it, diminished value will not come into play.Sorry about your accident! I fully agree with donalsonvilledawg about not doing this on your own. It is much easier if the truck is totaled, which is hopefully the case. Since it was brand new, the replacement cost would be determined by the cost of a another new truck. If it is heavily damaged, it is more problematic. The insurance company would cover the full cost of repairs and a rental vehicle during the repair process. The problem is you are then faced with making a diminution in value claim against the insurance company. This is extremely significant because your truck will never be as valuable with the damage from the accident. Whenever you sell or trade in your truck, you will get substantially less than actual value. Any Carfax or Auto check report will show the damage. The best approach for a diminution in value claim is to obtain an appraisal from a certified vehicle appraiser who will write a full report about the damage, repairs, and the reduction in value that resulted.

I felt fine at the time (Monday afternoon) but I woke up today with a sore lower back. I’m going to the Dr. when I get off work.Were you hurt?

File a police report, take pictures, get witness info and advise your insurance agent. Insurance companies have the duty to determine liability based on the evidence you present so make sure you have all your ducks in a row there. If the other guy is clearly at fault, call his insurance company and I would hold off on filing with your insurance company as long as you can drive your car. You just want to avoid paying that deductible if possible.

Speaking as a former auto claims adjuster and a current insurance agent...

Speaking as a former auto claims adjuster and a current insurance agent...

The other party is clearly at fault and it says that on the incident report. They got a failure to yield citation at the scene.File a police report, take pictures, get witness info and advise your insurance agent. Insurance companies have the duty to determine liability based on the evidence you present so make sure you have all your ducks in a row there. If the other guy is clearly at fault, call his insurance company and I would hold off on filing with your insurance company as long as you can drive your car. You just want to avoid paying that deductible if possible.

Speaking as a former auto claims adjuster and a current insurance agent...

Call @NWGA_DAWG

this is not a do it yourself thing OP. You’re going to get ferked if you try to handle on your own.

You’re going to get a lot of advice from dudes in this thread who aren’t lawyers. Their advice is wrong. Call an attorney today.

An attorney probably isn't going to be able to do a great deal for him regarding the PD claim. If he's hurt (and he says he is) that's a different story but if it's just PD only he can probably handle that himself

Except he won't get a proper settlement on his car value. He's gotta repair the car and get diminished value. The insurance company is going to give him $50 for the DV (which is absurd for a brand new car which, by being crashed, probably has lost THOUSANDS in value)Yes. If he is hurt. Call a lawyer for sure. If he isn’t hurt no lawyer is taking a case on whether he gets a proper settlement on his car value. But don’t tell autozone he has called a lawyer at all. The conversation is over at that point. Just sayin. Meant for @donalsonville_dawg sorry

Statistically he will get more with an attorney than he will by himself (enough to cover the fee). I'm not guessing on this; I know this stuff.

Last edited:

You may want to contact the salesperson that sold you the vehicle and give him a "heads up" on the situation. I'm thinking that he (or she) would be a good person to write out a statement expressing that the vehicle is still worth damn near what you paid for it. That may help with whatever adjuster you're dealing with.

As someone who used to work in claims, I can tell you that the insurance company will try to not even bring DV into the picture unless the Insured/Claimant brings it up. They don’t want to pay it, and they’ll try to pay as little as possible (most of the time).Except he won't get a proper settlement on his car value. He's gotta repair the car and get diminished value. The insurance company is going to give him $50 for the DV

Statistically he will get more with an attorney than he will by himself (enough to cover the fee). I'm not guessing on this; I know this stuff.

EDIT: The court case “Pritchett vs. State Farm Mut. Auto Ins. Co.” kind of set the guidelines for how companies were to calculate diminished value. However, it didn’t mandate any particular way. There’s a ton of discretion left to the Insurer, and some companies will take full advantage of that. Just be aware of what you’re getting into.

Almost like I knew what I was talking aboutAs someone who used to work in claims, I can tell you that the insurance company will try to not even bring DV into the picture unless the Insured/Claimant brings it up. They don’t want to pay it, and they’ll try to pay as little as possible (most of the time).

When it is repaired call the insurance company and demand diminished value payment. Your truck is worth less resale since there is an accident on it's record. Progressive wanted me to hire a professional appraiser to determine diminished value. I just filed a complaint on the Insurance commissioner's website . Progressive called me a few days later. They said there was no diminished value since my truck had over 100K. I informed them that it had 92K. They sent me a check.Someone driving an AutoZone delivery truck pulled out in front of me and I wrecked my brand new truck. When I say brand new I mean I had it for 2 weeks at it had around 700 miles on it. My question is, what can I do to make sure I don't get screwed by the insurance agency? The other driver was at fault and I haven't talked to their insurance people yet.

Go to KBB, Carvana and every other website. Print hard copies of the value with and without an accident. Get a written statement of diminished value from the dealership since you just bought it. You should get at least $1000. Maybe a lot more.

Make them rent a "similar" truck while yours is in the shop. Make them pay for it. Do not let them say they will reimburse you.

Keep a file with the name and phone number, date and time of everybody you talk to.

Your insurance company has attorneys that should be at your disposal that are experts at this type of stuff just call your insurance companyCall @NWGA_DAWG

this is not a do it yourself thing OP. You’re going to get ferked if you try to handle on your own.

You’re going to get a lot of advice from dudes in this thread who aren’t lawyers. Their advice is wrong. Call an attorney today.

I realize that this is a basic question but this is my first wreck. Who determines if it’s a total loss? Their adjuster?

Your insurance company has attorneys that should be at your disposal that are experts at this type of stuff just call your insurance company

Hoo boy

You’re going to get a lot of advice from dudes in this thread who aren’t lawyers. Their advice is wrong. Call an attorney today.

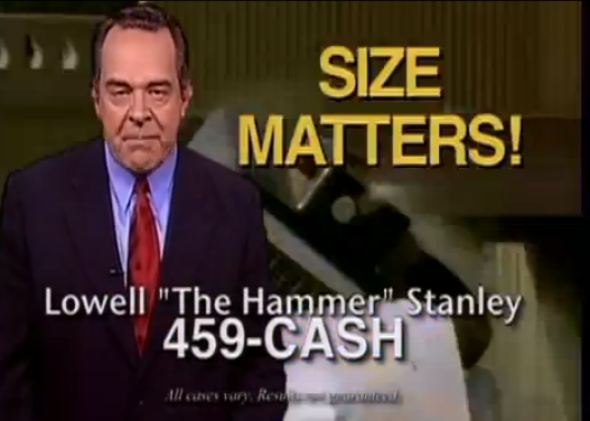

My man please call an attorney (preferably one who does not advertise on TV). This thread is littered with bad advice. An attorney will walk you through this.I realize that this is a basic question but this is my first wreck. Who determines if it’s a total loss? Their adjuster?

So are we making up advice based on TV shows, movies, or bc we had a wreck once under different circumstances and therefore we are an expert?

OP - I have guesses but you don’t want those. Listen to the attorneys on this board and find an attorney, and disregard everything else in this thread.

OP - I have guesses but you don’t want those. Listen to the attorneys on this board and find an attorney, and disregard everything else in this thread.

Hard to find a lawyer to take pd only claims. There isn’t enough money in it. I normally agree with you on all this type stuff, but here we don’t see eye to eye. If he is hurt, which he says he may be, you are 100 percent absolutely correct. Call an attorney. There is a good chance he will be just fine on a pd claim. Maybe it is just where I am, but I haven’t seen a 50 dollar diminished value check in 15 years. Yes, there is almost always an immediate check sent for minor damage within the formula for dv. (Whether it is more than minor or not)The value of cars now keeps that initial check much higher. The formula is out there too. It is getting harder to put that one over on people. He doesn’t even know his car is totaled. He will not need a lawyer to help him with the car if it isn’t totaled. I used to send some clients for referals with attorney on pd claims. Never had one take a case yet. Other than write a letter for 100 bucks. It is a brand new truck, so the value of an attorney may be there. The percentage may be worthwhile. But if you total your 10000 Camry and you aren’t hurt, don’t call an attorney to help get the value for it is all I am saying.Except he won't get a proper settlement on his car value. He's gotta repair the car and get diminished value. The insurance company is going to give him $50 for the DV

Statistically he will get more with an attorney than he will by himself (enough to cover the fee). I'm not guessing on this; I know this stuff.

Last edited:

Sure. If he said "I just got hit in my 1997 Accord and am not hurt", handle it yourself. His claim is probably worth several thousand dollars in PD and DV aloneHard to find a lawyer to take pd only claims. There isn’t enough money in it. I normally agree with you on all this type stuff, but here we don’t see eye to eye. If he is hurt, which he says he may be, you are 100 percent absolutely correct. Call an attorney. There is a good chance he will be just fine on a pd claim. Maybe it is just where I am, but I haven’t seen a 50 dollar diminished value check in 15 years. Yes, there is almost always an immediate check sent for minor damage within the formula for dv. The value of cars now keeps that initial check much higher. The formula is out there too. It is getting harder to put that one over on people. He doesn’t even know his car is totaled. He will not need a lawyer to help him with the car if it isn’t totaled. I used to send some clients for referals with attorney on pd claims. Never had one take a case yet. Other than write a letter for 100 bucks. It is a brand new truck, so the value of an attorney may be there. The percentage may be worthwhile. But if you total your 10000 Camry and you aren’t hurt, don’t call an attorney to help get the value for it is all I am saying.

My man please call an attorney (preferably one who does not advertise on TV). This thread is littered with bad advice. An attorney will walk you through this.

What about attorneys who advertise on billboards or on cars (not the cheap car magnets, but the classy car wraps)?My man please call an attorney (preferably one who does not advertise on TV). This thread is littered with bad advice. An attorney will walk you through this.

Our firm has some koozies because we're really classyWhat about attorneys who advertise on billboards or on cars (not the cheap car magnets, but the classy car wraps)?

Darth. I will make it easy for you. Call your agent first. Ask some of these questions. He or she will help you with the property damage portion of you claim. Sounds like you may be hurt. So you definitely want to call an attorney too. Do not call autozone until you have done both of these things. Pretty sure you attorney will not want you to talk to autozone’s company at all. Even if you get a clean bill of health. Call an attorney.I realize that this is a basic question but this is my first wreck. Who determines if it’s a total loss? Their adjuster?

We have coffee mugs. I’m always jealous of the residential closing firms and their huge candy assortmentsOur firm has some koozies because we're really classy

Hope you are okay. Call a lawyer now. Before you even talk to their insurance.

2.5 years ago I bought a Camry in Charlotte. Drove it off the lot and made it about 3 miles before someone smashed me in the rear and totaled it and almost me after owning the car for all of 10 minutes.

It was a pain, the title was a nightmare, paying it off was a nightmare, they would only give me a rental for 3 days, despite taking several months to process. The junkyard was a nightmare, the bank loan was a nightmare. I got the car after 5 pm on Friday so had no way to activate the insurance, the lady that hit me didn’t have enough insurance to cover me and my car. The state of Georgia put a Lein on my lawsuit to cover medical costs I incurred for half a year. I was so pissed, I wanted blood and I didn’t care who from. Interviewed 3 lawyers and picked one.

One thing I came to realize is how much power these insurance companies have and how the state’s law were mostly there to protect them and limit anything they may have to held responsible for. Lobbyists I guess.

I still feel like I got scr

2.5 years ago I bought a Camry in Charlotte. Drove it off the lot and made it about 3 miles before someone smashed me in the rear and totaled it and almost me after owning the car for all of 10 minutes.

It was a pain, the title was a nightmare, paying it off was a nightmare, they would only give me a rental for 3 days, despite taking several months to process. The junkyard was a nightmare, the bank loan was a nightmare. I got the car after 5 pm on Friday so had no way to activate the insurance, the lady that hit me didn’t have enough insurance to cover me and my car. The state of Georgia put a Lein on my lawsuit to cover medical costs I incurred for half a year. I was so pissed, I wanted blood and I didn’t care who from. Interviewed 3 lawyers and picked one.

One thing I came to realize is how much power these insurance companies have and how the state’s law were mostly there to protect them and limit anything they may have to held responsible for. Lobbyists I guess.

I still feel like I got scr

Yeah. He gets first shot at it.I realize that this is a basic question but this is my first wreck. Who determines if it’s a total loss? Their adjuster?

I used to work in insurance and if you think it is even POSSIBLY totaled, it almost certainly is.

edit: ESPECIALLY on a front end collision.

When we sold our rental a few years ago we made more profit in candy than we did on the house.We have coffee mugs. I’m always jealous of the residential closing firms and their huge candy assortments

I was able to up our profit margin up by 1% from pixie sticks alone.

Similar threads

- Replies

- 33

- Views

- 1K

- Replies

- 38

- Views

- 1K

NonDawg UPDATE: Ever had an insurance adjuster not come back with a better offer from an auto accident?...

- Replies

- 50

- Views

- 1K

- Replies

- 50

- Views

- 1K

ADVERTISEMENT

ADVERTISEMENT