2022 imo not 2021You’re taxes will be much less for 2020 than they will be going forward. Biden and Dems will ultimately tax the VALUE of your stocks, so getting out will have been wise when you did.

This is the 2008 bubble on roids. This thing will crash by summer, and I mean CRASH. There is no reason now for this exuberance. US and Canada both shed tens of thousands of jobs in December and the world is going to follow. 2021 will be a survival year.

I have shifted to cash and gotten out. Earlier than the highest price, but still profitable.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Any stock picks?

- Thread starter ugaballers

- Start date

Basically forces you to not have a brokerage account that isn’t tax advantagedI think what you are likely to see for the first time is LT gains taxed according to your ordinary income for the year in which you sell. I’ve talked to a few connected Washington types and they think this is the likely scenario Biden pursues. Basically this as usual would pacify the ultra wealthy lefties but raise taxes for the upper class and upper middle class. I don’t think you’ll see 1031 exchanges touched.

Also look at nonqualified variable whole life policies.Basically forces you to not have a brokerage account that isn’t tax advantaged

The issue I understand about those has always been fees. Is something changingAlso look at nonqualified variable whole life policies.

No nothing will change there but it will likely be a shelter in the Biden environment depending on what one’s income is. Just look into it and see what you think but for middle income to upper middle income it’s probably going to be an available shelter where the fees outweigh the potential taxes. It will be for the passive investor.The issue I understand about those has always been fees. Is something changing

Usually there are loopholes when it comes to a shift in policy. Just look for them.

Last edited:

You HOPE it will get reversed. I dunnountil sometime in 2021, when capital gains start getting taxed as ordinary income,

2022 should see the tax reform where wokeness mandates that the act of investing is, in itself,discriminatory, and capital gains are taxed at more than ordinary income. Because saving is something rich people do, and the rich need to pay their fair share.

but, just hold thru it - it will all get reversed in early 2025

Nah. I think the “urgency” of the economy for 2021 will put this in play. If it occurs for 2022, it will be an election issue and Biden will lose both houses of Congress over it as the economy would be worse than when he got it. Doing it for 2021 will allow the economy to recover some and he tout himself. Pelosi, Schumer want to tax 401k values too, don’t be surprised when that comes about.2022 imo not 2021

I know they want to tax 401k values, that shoe will drop.Nah. I think the “urgency” of the economy for 2021 will put this in play. If it occurs for 2022, it will be an election issue and Biden will lose both houses of Congress over it as the economy would be worse than when he got it. Doing it for 2021 will allow the economy to recover some and he tout himself. Pelosi, Schumer want to tax 401k values too, don’t be surprised when that comes about.

I know they want to tax 401k values, that shoe will drop.

Def not saying your wrong but I can't any info on it. Could you link me to this?

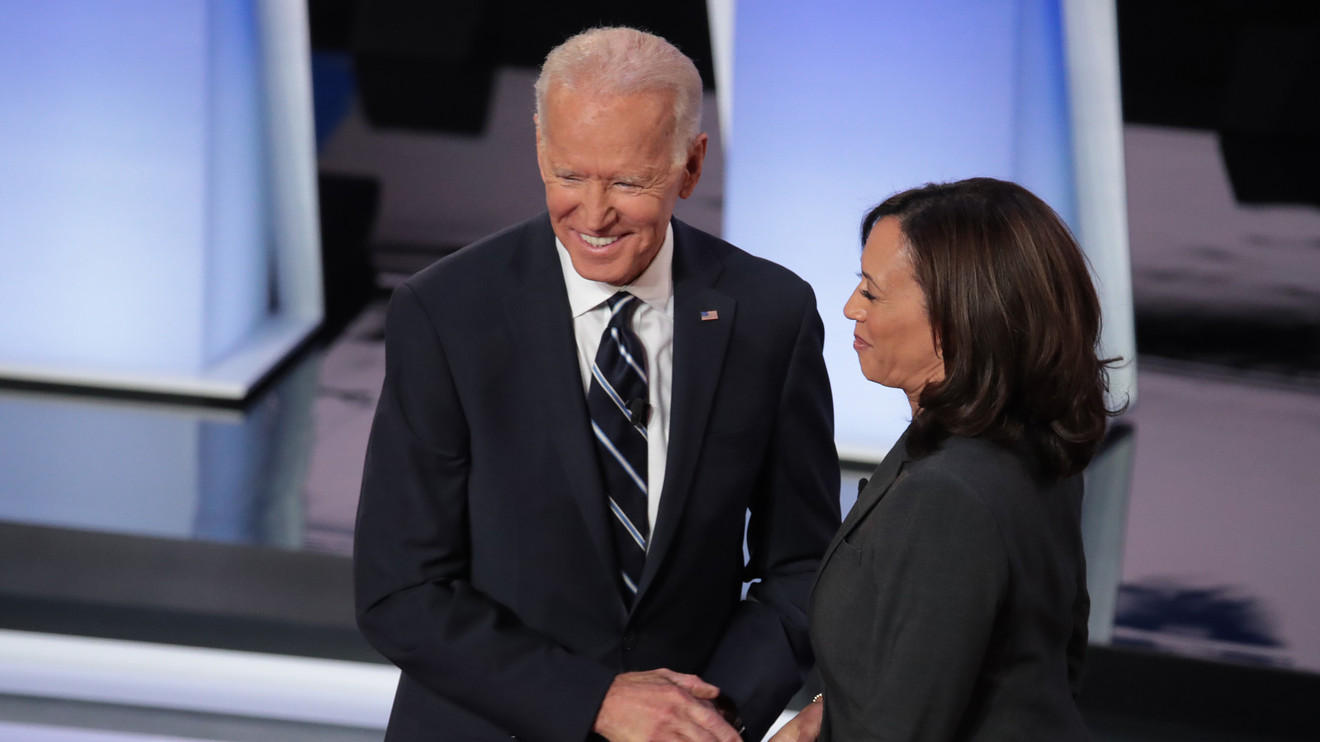

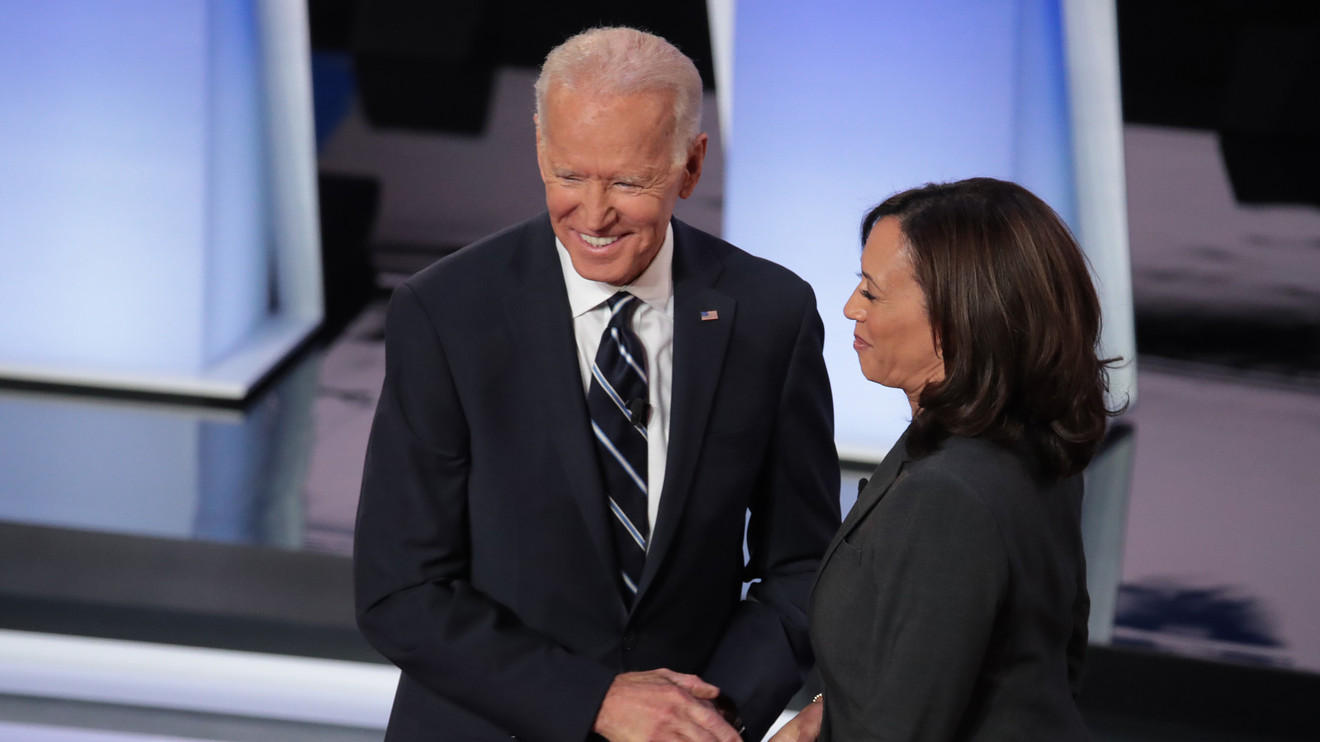

Conjecture on my part. The overall tone of haves and have nots that has been pushed for a while. But if you want to read how the new admin wants to back door tax the rich and subsidize the poor, here you goDef not saying your wrong but I can't any info on it. Could you link me to this?

Theft by takingI know they want to tax 401k values, that shoe will drop.

Good reading. Thank you for the article. I just started to boost my Roth IRA contributions and will look at that within my 401k because we do have that option of Roth in there.Conjecture on my part. The overall tone of haves and have nots that has been pushed for a while. But if you want to read how the new admin wants to back door tax the rich and subsidize the poor, here you go

There is an argument to be made only contribute the amount that is matched and push the rest to traditional Ira that you can convert to Roth. Depending on your income level.Good reading. Thank you for the article. I just started to boost my Roth IRA contributions and will look at that within my 401k because we do have that option of Roth in there.

Yes, may need to rethink some of this. I contribute 10%, match is 50% on first 6%. I used to max at 19% early on before kids. Appreciate the info.There is an argument to be made only contribute the amount that is matched and push the rest to traditional Ira that you can convert to Roth. Depending on your income level.

Quantum Scape has come up with a new form of solid state battery. Stock price (QS) has gone through the roof. The battery won't be ready for another couple of years, but this could be a one time technological event. The stock has appreciated by a low of $ 58 last week to around $ 125 today.

(LAZR) makes lidar sensors for cars. I bought 2000 shares yesterday when it started to run. Finished up 8% and is up about 3.5% today.

And of course, (AAPL) looks ready to run again.

And . . .QS is $47 and the company being sued

Look at companies the govt supports and buy that. Markets seem to love corporate fascism. Just figure out the pre-determined winners and buy that. I would imagine that is what smart brokers are trying to do for their clients.Feels like market is overweight with most companies returning to pre COVID valuations / price. Was thinking about dipping toe in hotel/services which is still depressed. Any Gordon Geckos our there?

Sell as fast as you canyall are welcome

I hold Arkk. I’ll probably have it forever. Arkg is a monster. I have quite a bit (for a poor ga boy) of Teledoc from the livongo merger. Cathie has bought a ton of that recently. Hope she is right on that one. I ain’t selling.

ARK funds and TDOC getting absolutely crushed right now. You buying more? I know Cathie did...

ITRM, once they get their ADCOM date set. FDA screwed them over by moving back the prior date. Decision is still scheduled for July 25 for now. They have a big conference coming up next Thursday that will hopefully clarify some things.

No position in the meantime, but I'll load up sub-$1 if the opportunity presents itself. Closed at $1.03 today and will probably have another dip prior to the conference.

No position in the meantime, but I'll load up sub-$1 if the opportunity presents itself. Closed at $1.03 today and will probably have another dip prior to the conference.

Nope got out of tdoc. May get back in later. Gonna see how they do for a bit. I’ll stay in Arkk. It’s not gonna be good for a few quarters I don’t think. I’ll use it for my growth stocks which have lost their favor on Wall Street. They will be back at some point. I’m 70% Arkk, VTI, QQQ, VXUS. Then I spread the rest out over sq, mgm, swks, msft, crwd, ba. It’s not been great lately. Several of those stocks have pulled back a decent amount in the last few months but I still like them long term.ARK funds and TDOC getting absolutely crushed right now. You buying more? I know Cathie did...

DAWGCOIN.PLTR,IPOE,Oil Stocks are the runners this summer imhoI bought leaps on Goldman. Good so far

Similar threads

- Replies

- 66

- Views

- 2K

- Replies

- 93

- Views

- 3K

- Replies

- 216

- Views

- 3K

ADVERTISEMENT

ADVERTISEMENT