March 13, 2020 ? Have you forgotten the day worse than 9/11 for most of us?

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Are you better off than you were four years ago?

- Thread starter MRDAWG

- Start date

No. Biden needs to be fired and all the rest of the swamp. To Mitch don’t let the door hit you in the a$$ on the way out.March 13, 2020 ? Have you forgotten the day worse than 9/11 for most of us?

by the coming Wednesday, a close family friend was dead. His wife died on the Friday. Each died alone.March 13, 2020 ? Have you forgotten the day worse than 9/11 for most of us?

yes, by every metric.

Plus the dawgs won 2 national championships and the Braves won a World Series so i’d say that makes us all better off.

Plus the dawgs won 2 national championships and the Braves won a World Series so i’d say that makes us all better off.

By every economic measure, we are better off.March 13, 2020 ? Have you forgotten the day worse than 9/11 for most of us?

to answer the question: I am better off as well. I think most of us answering honestly would say yes, even adjusting for the pandemic.I'm better off but my country isn't.

No. I was gaining in 21, but having a large family makes it impossible to be better. 1500 more a month on my monthly bills. Just wrote a check for 8000 more in taxes last year, My 25 year old daughter had to move back home. Because you can’t make ends meet with a normal job anymore. She would rather move home than take on stranger roommates. My industry has fired a lot of people. And the top dog, lost 30 billion dollars in the last two years.

I am worth more. But that happens no matter who is in office I believe. It is paper money. Not selling my house. Or my business. It isn’t real. The only people doing better in this economy are upper middle class with two children or less. Or the already rich, who are now much richer. The Democrat mirage. Hurt the middle class and smash the poor, while claiming we are only taxing the rich. If you are doing better, I get why you argue for Joe.

I remember having an argument with Payne. Joe said he would only raise taxes on people making more than 400000. That is like i said then 10000 percent bullshit. When you monkey with the tax bracket numbers. Also, more being taken out of people making less than 40000 a year too. Both of my older kids red pilled on that.

People questioning my post. Just refer to the massive amount of credit card debt and heloc debt in this country. Largest in our history.

I am worth more. But that happens no matter who is in office I believe. It is paper money. Not selling my house. Or my business. It isn’t real. The only people doing better in this economy are upper middle class with two children or less. Or the already rich, who are now much richer. The Democrat mirage. Hurt the middle class and smash the poor, while claiming we are only taxing the rich. If you are doing better, I get why you argue for Joe.

I remember having an argument with Payne. Joe said he would only raise taxes on people making more than 400000. That is like i said then 10000 percent bullshit. When you monkey with the tax bracket numbers. Also, more being taken out of people making less than 40000 a year too. Both of my older kids red pilled on that.

People questioning my post. Just refer to the massive amount of credit card debt and heloc debt in this country. Largest in our history.

Last edited:

Anyone who makes 60000 a year or less on this board doing better? Will anyone on the board admit this is what they make? If no one says yes, it makes this thread useless.

In a similar boat. I own a transportation company that deals mostly with raw materials for manufacturing and our expenses are exploding while our rates are collapsing because demand is dying. What I'm seeing now is actually worse than the lead up to 2008. I'll be okay but it's almost impossible now to manage expenses because I have no idea how much something as simple as a tire might cost in 3 months.No. I was gaining in 21, but having a large family makes it impossible to be better. 1500 more a month on my monthly bills. Just wrote a check for 8000 more in taxes last year, My 25 year old daughter had to move back home. Because you can’t make ends meet with a normal job anymore. She would rather move home than take on stranger roommates. My industry has fired a lot of people. And the top dog, lost 30 billion dollars in the last two years.

I am worth more. But that happens no matter who is in office I believe. It is paper money. Not selling my house. Or my business. It isn’t real. The only people doing better in this economy are upper middle class with two children or less. Or the already rich, who are now much richer. The Democrat mirage. Hurt the middle class and smash the poor, while claiming we are only taxing the rich. If you are doing better, I get why you argue for Joe.

I remember having an argument with Payne. Joe said he would only raise taxes on people making more than 400000. That is like a said. 10000 percent bullshit. When you monkey with the tax bracket numbers. Also, more being taken out of people making less than 40000 a year too. Both of my older kids red pilled on that.

People questioning my post. Just refer to the massive amount of credit card debt and heloc debt in this country. Largest in our history.

I own an insurance agency. State Farm is the largest insurer in the ole U.S. of a. They lost 30 billion dollars in the last two years. It makes the companies not number 1 a little worried. No shot at State Farm. I worked for them years ago. Enjoyed my time there. But losing 30 billion then hiring Arnold as you new spokesperson makes me question leadership thereIn a similar boat. I own a transportation company that deals mostly with raw materials for manufacturing and our expenses are exploding with our rates are collapsing because demand is dying. What I'm seeing now is actually worse than the lead up to 2008. I'll be okay but it's almost impossible now to manage expenses because I have no idea how much something as simple as a tire might cost in 3 months.

You can’t eat those stats. They don’t help folks who used to be able to buy a house, pay less than 20 percent of income on housing, etc.

And if you really do want to look at the only measure / stat that regular folks give a shut about. It is real wages. At the three year mark of Trump they were up 7 percent. Under Biden they are down.

The housing thing is the one that I don’t see folks talk enough about. Locked into homes too small and / or can’t afford to buy a new one because of rates / pricing. People are pissed. I suspect the disconnect in your data relative to how folks feel about the economy lies here.

You are a good debater. Economy and border are ones you should know to stay away from unless things really change for the better.

Same here. Sold my business at the end of 2021 and the company that bought it is struggling due to the increased cost of everything. They are a huge company so they can survive but I am glad I am out.I'm better off but my country isn't.

Credit card debt is the canary in the coal mine. All the headlines about retail spending and GDP = Government spending funded by debt. And consumer spending funded by credit cards. Auto loan delinquencies at all time highs. Very rare with low unemployment.No. I was gaining in 21, but having a large family makes it impossible to be better. 1500 more a month on my monthly bills. Just wrote a check for 8000 more in taxes last year, My 25 year old daughter had to move back home. Because you can’t make ends meet with a normal job anymore. She would rather move home than take on stranger roommates. My industry has fired a lot of people. And the top dog, lost 30 billion dollars in the last two years.

I am worth more. But that happens no matter who is in office I believe. It is paper money. Not selling my house. Or my business. It isn’t real. The only people doing better in this economy are upper middle class with two children or less. Or the already rich, who are now much richer. The Democrat mirage. Hurt the middle class and smash the poor, while claiming we are only taxing the rich. If you are doing better, I get why you argue for Joe.

I remember having an argument with Payne. Joe said he would only raise taxes on people making more than 400000. That is like i said then 10000 percent bullshit. When you monkey with the tax bracket numbers. Also, more being taken out of people making less than 40000 a year too. Both of my older kids red pilled on that.

People questioning my post. Just refer to the massive amount of credit card debt and heloc debt in this country. Largest in our history.

Gonna encourage you to read this whole piece by a totally unbiased source who knows a lot about it. Completely data driven which is why you’ll appreciate it. Tells a real story that plays into both the border issue and what is really behind the “rosy” job market. You may argue the Prez is doing a good job on jobs, maybe doing his best with the hand he’s been dealt on global inflation - but I challenge you to come to a different conclusion than JP in this article.

BLS jobs data dive.

Yep. This is why the numbers they tout don’t mean anything when it comes to economy approval. This really will be an interesting election. Could turn things forever. If Trump doesn’t run that into the ground with his mouth. The elite Dems running the country left a big portion of their base behind. Which constitutes a ton of people in the 36 percent approval for Biden. Will they still blindly vote left. Will they believe the propaganda or vote how they are feeling? If this changes. The Dems are in a heap of shit. There is a lot of evidence that their core voter is starting to see the light.Credit card debt is the canary in the coal mine. All the headlines about retail spending and GDP = Government spending funded by debt. And consumer spending funded by credit cards. Auto loan delinquencies at all time highs. Very rare with low unemployment.

Did not compare to 9/11 at all.March 13, 2020 ? Have you forgotten the day worse than 9/11 for most of us?

Monetarily speaking no……day to day spending has not been as good as the guy before Biden.March 13, 2020 ? Have you forgotten the day worse than 9/11 for most of us?

The inflation adjusted wages (real world) were +7.1% when the guy before Biden left office. I went back 47 years to Jimmy Carter……and no one comes close to that +7.1% number.

Pretty sure you can go back even further than that and you will have the same answer.

Day to day spending and security are important to most folks.

The market is up, but last I checked….percent wise, the guy before Joe was even better in that department.

Credit Card debt as a percentage of total income is below pre-pandemic levels. It is not a 'canary in a coal mine'.

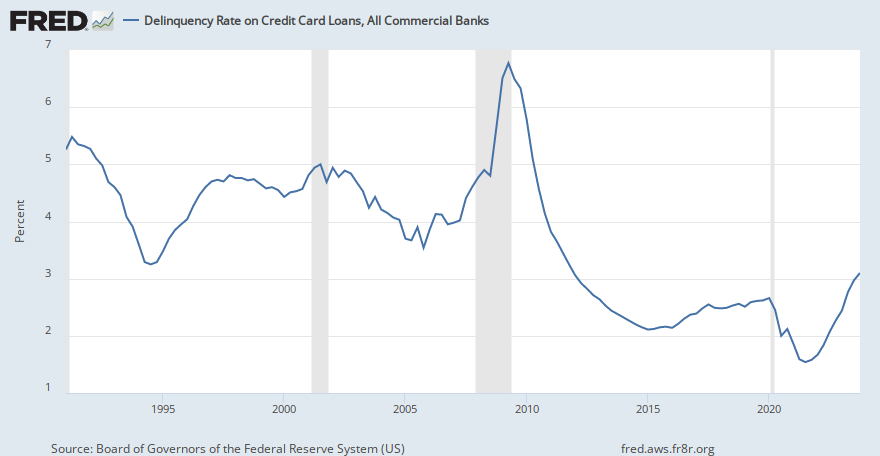

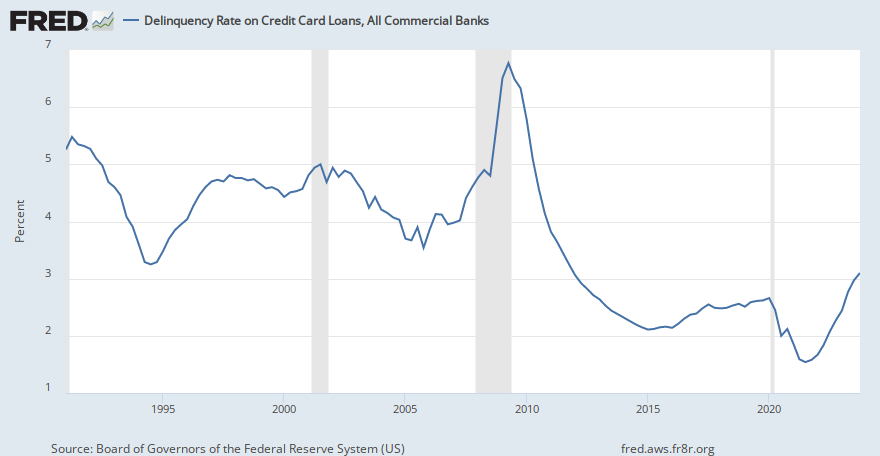

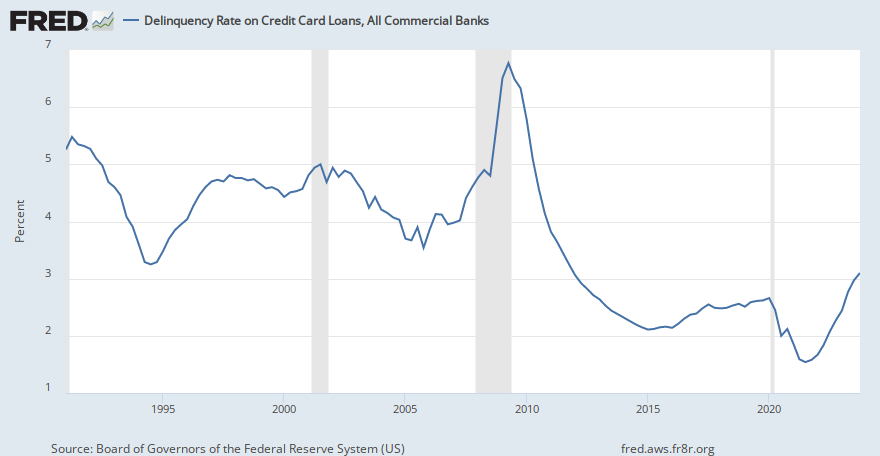

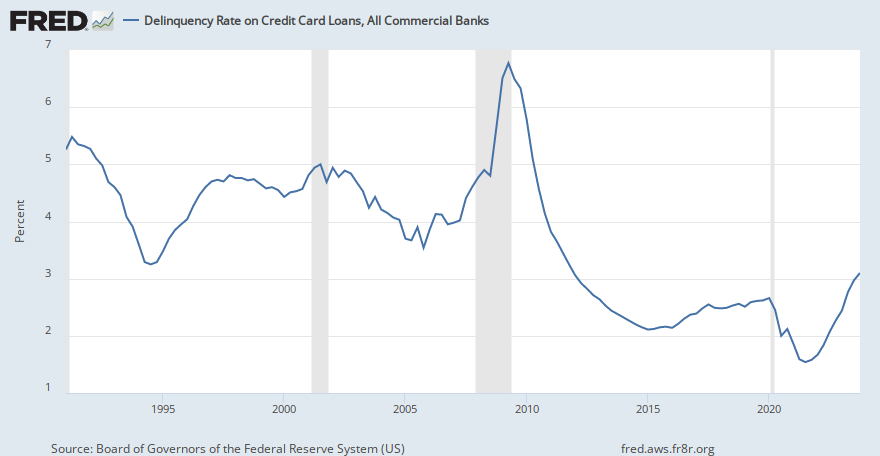

Despite higher interest rates, delinquency rates are well below historical trends:

Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks/Personal Income | FRED | St. Louis Fed

Graph and download economic data for Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks/Personal Income from Jan 1959 to Apr 2024 about revolving, credit cards, loans, consumer, banks, depository institutions, USA, headline figure, personal income, personal, and income.

fred.stlouisfed.org

Despite higher interest rates, delinquency rates are well below historical trends:

Delinquency Rate on Credit Card Loans, All Commercial Banks

Graph and download economic data for Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) from Q1 1991 to Q4 2023 about credit cards, delinquencies, commercial, loans, banks, depository institutions, rate, and USA.

fred.stlouisfed.org

And why was there a giant spike right before he left office? The government gave people and businesses $2.2T...Monetarily speaking no……day to day spending has not been as good as the guy before Biden.

The inflation adjusted wages (real world) were +7.1% when the guy before Biden left office. I went back 47 years to Jimmy Carter……and no one comes close to that +7.1% number.

Pretty sure you can go back even further than that and you will have the same answer.

Day to day spending and security are important to most folks.

The market is up, but last I checked….percent wise, the guy before Joe was even better in that department.

Employed full time: Median usual weekly real earnings: Wage and salary workers: 16 years and over

Graph and download economic data for Employed full time: Median usual weekly real earnings: Wage and salary workers: 16 years and over (LES1252881600Q) from Q1 1979 to Q1 2024 about full-time, salaries, workers, earnings, 16 years +, wages, median, real, employment, and USA.

fred.stlouisfed.org

Americans' credit card debt hits record $1.13 trillion

Credit card debt increased by $50 billion in the fourth quarter of 2023 alone, a 4.6% jump from the previous quarter.

This says differently. 1.13 trillion in credit card debt is the number. Up 5 percent in the last quarter.

“The borrower is slave to the lender”.Credit Card debt as a percentage of total income is below pre-pandemic levels. It is not a 'canary in a coal mine'.

Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks/Personal Income | FRED | St. Louis Fed

Graph and download economic data for Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks/Personal Income from Jan 1959 to Apr 2024 about revolving, credit cards, loans, consumer, banks, depository institutions, USA, headline figure, personal income, personal, and income.fred.stlouisfed.org

Despite higher interest rates, delinquency rates are well below historical trends:

Delinquency Rate on Credit Card Loans, All Commercial Banks

Graph and download economic data for Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) from Q1 1991 to Q4 2023 about credit cards, delinquencies, commercial, loans, banks, depository institutions, rate, and USA.fred.stlouisfed.org

Who in their right mind would want to borrow money these days with the interest rates the way they are.

Besides, the question was who is better off.

Auto loan delinquencies spiked last year in troubling sign for economy | Fox Business

The number of auto loan borrowers who are falling behind on their bills jumped during the fourth quarter as high borrowing costs squeeze millions of Americans.

The highest level of delinquency since 2010. Up 7.6 percent in the last quarter.

I posted video of the 2012 VP debate compared with a montage of stumbling mumbling Joe today to illustrate how far he's dropped. But the other thing that was clear in listening to some of that video is that the democratic party has changed so much. There is a reason working class folks vote Trump. Dems used to truly be the party of the little guy; with republicans all about the rich folks. Total 180 nowadays. Wall Street is by and large Democrat. And aside from certain unions who effectively force votes towards democrats, in general the typical working class dude cannot stand Biden.Yep. This is why the numbers they tout don’t mean anything when it comes to economy approval. This really will be an interesting election. Could turn things forever. If Trump doesn’t run that into the ground with his mouth. The elite Dems running the country left a big portion of their base behind. Which constitutes a ton of people in the 36 percent approval for Biden. Will they still blindly vote left. Will they believe the propaganda or vote how they are feeling? If this changes. The Dems are in a heap of shit. There is a lot of evidence that their core voter is starting to see the light.

Market popped 50%+ under Trump, with gains broadly enjoyed across the market - all sectors and sizes of businesses.Monetarily speaking no……day to day spending has not been as good as the guy before Biden.

The inflation adjusted wages (real world) were +7.1% when the guy before Biden left office. I went back 47 years to Jimmy Carter……and no one comes close to that +7.1% number.

Pretty sure you can go back even further than that and you will have the same answer.

Day to day spending and security are important to most folks.

The market is up, but last I checked….percent wise, the guy before Joe was even better in that department.

Under JB the Dow has popped 25% or so I believe - HEAVILY weighted to the Mag 7 Tech Companies. Smaller public companies flat or down. To say nothing about the majority of American businesses - the ones not publicly traded - struggling to get capital due to interest rates and lending standards. Economy sucks.

Won't argue those stats. What worries me is the rate that delinquencies have gone from zero to where they are now, and the speed at which credit card balances increased. Let's also remember that those balances are carrying rates that are 500 bps higher than they were just a couple years ago. It is the trend that is worrisome, more than the balances and delinquency rates as a percentage of income. A legit argument though.Credit Card debt as a percentage of total income is below pre-pandemic levels. It is not a 'canary in a coal mine'.

Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks/Personal Income | FRED | St. Louis Fed

Graph and download economic data for Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks/Personal Income from Jan 1959 to Apr 2024 about revolving, credit cards, loans, consumer, banks, depository institutions, USA, headline figure, personal income, personal, and income.fred.stlouisfed.org

Despite higher interest rates, delinquency rates are well below historical trends:

Delinquency Rate on Credit Card Loans, All Commercial Banks

Graph and download economic data for Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) from Q1 1991 to Q4 2023 about credit cards, delinquencies, commercial, loans, banks, depository institutions, rate, and USA.fred.stlouisfed.org

Also think about this. How many folks make a living in one way or another on home sales? Mortgage brokers, loan officers, real estate agents, builders, renovation folks, etc, etc. The market for home sales has been effectively frozen for two years now. The saying is you go broke slowly, then all at once. I suspect folks have been spending money the same way they always have, predicting better times ahead. Meanwhile racking up debt and running out of savings.

If people are paying $1000 a month for a new car as indicated in the article, they made a bad financial decision and should just buy a bike. They deserve to default and learn their lesson. That's insane and just a bad decision. I'm sorry to be crass but DANG.Auto loan delinquencies spiked last year in troubling sign for economy | Fox Business

The number of auto loan borrowers who are falling behind on their bills jumped during the fourth quarter as high borrowing costs squeeze millions of Americans.www.foxbusiness.com

The highest level of delinquency since 2010. Up 7.6 percent in the last quarter.

Some of these problems are self inflicted and easily avoidable.

A quick Google shows you can go to carmax right now and buy a 2021 nissan Altima under 40k miles for under 25k and pay 1/3 of that cost (even at 7% auto loan rate over 60 months).

There are ways to survive this. I feel like I'm screaming into the void though....

The "up 5 percent" part is the canary in the coal mine. More so than the balances themselves.

Americans' credit card debt hits record $1.13 trillion

Credit card debt increased by $50 billion in the fourth quarter of 2023 alone, a 4.6% jump from the previous quarter.abcnews.go.com

This says differently. 1.13 trillion in credit card debt is the number. Up 5 percent in the last quarter.

People borrow because they have to, not because they want to. Unfortunately many can't even borrow because they won't qualify to buy a home given the higher interest rates.“The borrower is slave to the lender”.

Who in their right mind would want to borrow money these days with the interest rates the way they are.

Besides, the question was who is better off.

Here's hoping Joe uses the "just ride a bike" pitch on the economy.If people are paying $1000 a month for a new car as indicated in the article, they made a bad financial decision and should just buy a bike. They deserve to default and learn their lesson. That's insane and just a bad decision. I'm sorry to be crass but DANG.

Some of these problems are self inflicted and easily avoidable.

A quick Google shows you can go to carmax right now and buy a 2021 nissan Altima under 40k miles for under 25k and pay 1/3 of that cost (even at 7% auto loan rate over 60 months).

There are ways to survive this. I feel like I'm screaming into the void though....

No that's my advice. Know your limits. Personal accountability right?Here's hoping Joe uses the "just ride a bike" pitch on the economy.

Show me a person complaining about paying 1000 a month for a vehicle I will show you a fool...

Biden or any president shouldn't be responsible for people's bad decisions.

You aren't wrong about personal accountability. But this is a debate about policy and the economy. You are making the point for the folks who want Biden out.No that's my advice. Know your limits. Personal accountability right?

Show me a person complaining about paying 1000 a month for a vehicle I will show you a fool...

Biden or any president shouldn't be responsible for people's bad decisions.

That point being that someone who does want to buy a home or a car shouldn't have to weigh a poor financial decision versus riding a bike or staying in a studio apartment. In 2019 they didn't have to make that decision. They could afford both. Which is why making the personal accountability ride a bike pitch would be political suicide. Economy sucks and people are rightly pissed.

I hear what you are saying. But there has always been self inflicted wounds with finances. That isn’t changing. A percentage I don’t feel sorry for either. Here is the kicker. You see the credit card debt is at its highest ever. Well, that lowers credit. And if you can find a 7 percent interest rate at Carmax with average to poor credit, I will kiss your ass twice on Sunday. This is the squeeze I am referring to. That loan is now 14 percent. The 7 percent is just to get you to call. By they way, two years ago that rate offered to get the phone ringing was four percent. Then they hit you with 11 percent when you get there. The fact that a 21 Nissan Altima with 40k miles is 25000 dollars is the other problem created by the admin. Car values have sky rocketed. In 2020 you could get a brand new Altima for that. Matter of fact I googled it. 24000 for a brand new Altima in 2020.If people are paying $1000 a month for a new car as indicated in the article, they made a bad financial decision and should just buy a bike. They deserve to default and learn their lesson. That's insane and just a bad decision. I'm sorry to be crass but DANG.

Some of these problems are self inflicted and easily avoidable.

A quick Google shows you can go to carmax right now and buy a 2021 nissan Altima under 40k miles for under 25k and pay 1/3 of that cost (even at 7% auto loan rate over 60 months).

There are ways to survive this. I feel like I'm screaming into the void though....

So the car hasn’t lost its value. Great right? Except the interest rate to buy it is higher and the trade value has dropped tremendously. It seems like you are a financial guy of some sort. This isn’t something foreign. You do see a brand new truck in 2020 was 40000. Now it is 70-100. That is a problem. And why auto insurance rates have exploded. Just another issue with the economy the numbers don’t cover.

Nope.

Gas is more and food is more $ both up

By about 40%. My taxes are higher and my God given freedoms have suffered further theft under this government.

Gas is more and food is more $ both up

By about 40%. My taxes are higher and my God given freedoms have suffered further theft under this government.

Chris Hayes .....partisian hack. He's an activist not a journalist. Oh, and Lester ****ing Holt.....lmao! Under Trump - 1.2% inflation, border under control and zero ****ing wars.....did I mention $2 gas and my investments at record highs?

The bike bit is mine and not a political cry. Send me these people's phone numbers now and I will tell them all personally. I dont care if they cuss me out....been there, done that this week alone.You aren't wrong about personal accountability. But this is a debate about policy and the economy. You are making the point for the folks who want Biden out.

That point being that someone who does want to buy a home or a car shouldn't have to weigh a poor financial decision versus riding a bike or staying in a studio apartment. In 2019 they didn't have to make that decision. They could afford both. Which is why making the personal accountability ride a bike pitch would be political suicide. Economy sucks and people are rightly pissed.

Biden didn't sit down with the finance officer an force the buyer to sign up for 1000 a month.

There is nothing....nothing...you can say to me to make me feel sorry for a borrow defaulting on $1000 a month car loan.

My Altima example, let's go 14% interest rate, it is still less than $600 per month for 60 months. And that's with no money down. $1000 a month is just a crazy idea and I couldn't believe it when I read it.I hear what you are saying. But there has always been self inflicted wounds with finances. That isn’t changing. A percentage I don’t feel sorry for either. Here is the kicker. You see the credit card debt is at its highest ever. Well, that lowers credit. And if you can find a 7 percent interest rate at Carmax with average to poor credit, I will kiss your ass twice on Sunday. This is the squeeze I am referring to. That loan is now 14 percent. The 7 percent is just to get you to call. By they way, two years ago that rate offered to get the phone ringing was four percent. Then they hit you with 11 percent when you get there. The fact that a 21 Nissan Altima with 40k miles is 25000 dollars is the other problem created by the admin. Car values have sky rocketed. In 2020 you could get a brand new Altima for that. Matter of fact I googled it. 24000 for a brand new Altima in 2020.

So the car hasn’t lost its value. Great right? Except the interest rate to buy it is higher and the trade value has dropped tremendously. It seems like you are a financial guy of some sort. This isn’t something foreign. You do see a brand new truck in 2020 was 40000. Now it is 70-100. That is a problem. And why auto insurance rates have exploded. Just another issue with the economy the numbers don’t cover.

I use Altima as an example because I had one right out of college and it lasted 10 years for me. Only upgraded because our family got bigger. We beat that bad boy up though. Haha. It's a good car, affordable, and gets the job done (great gas mileage). Perfect for today's environment.

People buying what they want (70k trucks) vs what they need (30k affordable vehicles) is what gets them upside down in most cases. Then they complain about gas to fuel the 70k truck too. No policy can be inacted to save people from their bad decisions.

That $400+ a month savings on a car (and more on gas) could have gone to rent for a studio apartment, groceries, or maybe even savings if they are fortunate enough to get there.

It can be done if some people actually try.

Sorry...this car thing has been a thorn in my side for a while now and I don't mean to take it out on anyone here...I'm sure you're all great people and folks I wouldn't mind having a beer with.

Can only speak for myself…..People borrow because they have to, not because they want to. Unfortunately many can't even borrow because they won't qualify to buy a home given the higher interest rates.

Mortgages are a little different, most don’t have that kind of cash…..you have to borrow, but use some “personal responsibility”. The goal is, at least for me is to be debt free and remain that way.

Fortunately, we are.

If you continue to borrow, you more than likely will always owe….it’s a vicious cycle. The only exception I ever make to borrow is if the interest rates to finance is lower than what I am yielding….I will use their money then and pay it off when it is advantageous to me.

Otherwise, you never reach your goal of being debt free and then being able max out on investments……it’s called freedom in my book and it changes your lifestyle.

It’s all a slow process.

Not easy, but it works for me……not to many things in life are easy. There are always sacrifices, but too many folks don’t want to sacrifice or do not understand how to.

Last edited:

Just hope the government doesn’t steal all the social security tax money that we’ve paid in for years and give it to the illegals.Nope.

Gas is more and food is more $ both up

By about 40%. My taxes are higher and my God given freedoms have suffered further theft under this government.

That account has been raided for years, thinks doing so would just about do it.

Similar threads

- Replies

- 1

- Views

- 108

- Replies

- 1

- Views

- 152

- Replies

- 3

- Views

- 313

ADVERTISEMENT

ADVERTISEMENT