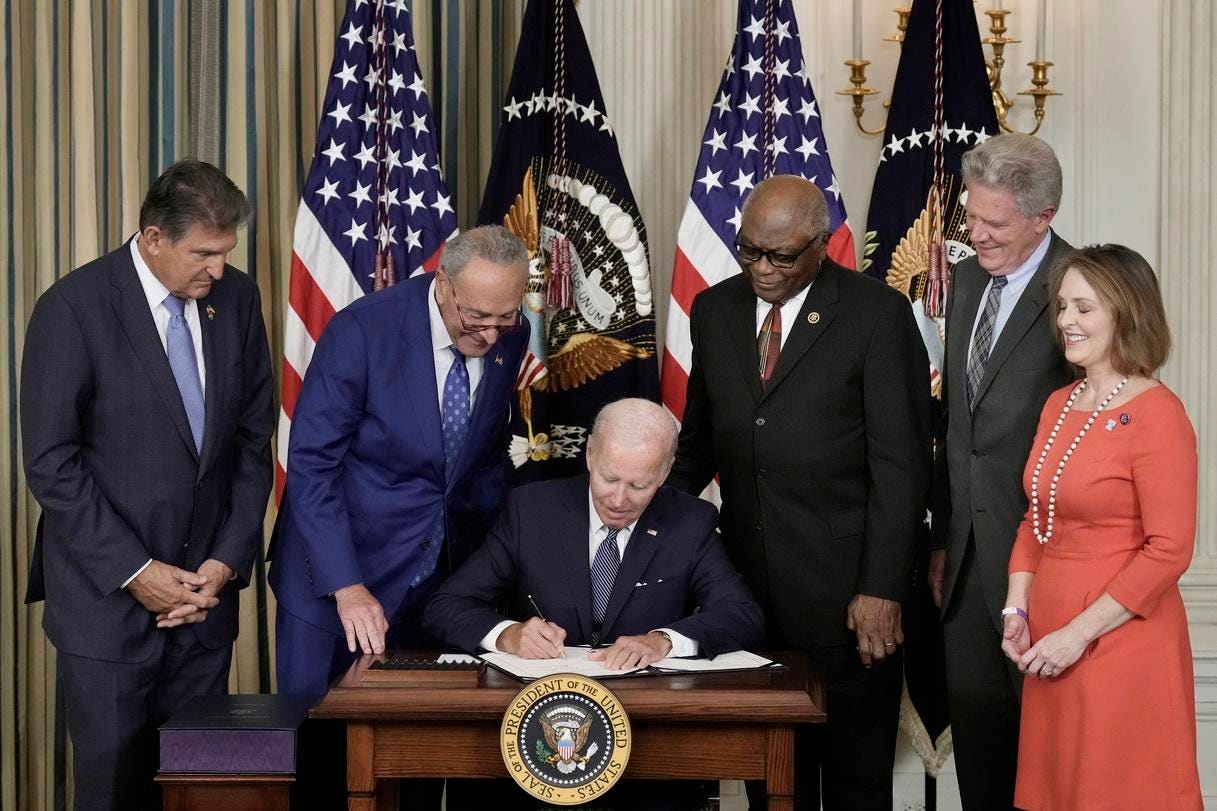

They controlled the

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Thank God Trump was potus when we sold our business. If the capital gains tax were 45% I would still be working.They controlled the

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

Link? \They controlled the

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

Wrong that is a very narrow and simplistic conclusion. It is always much more complex than that. We had a surplus 1998 to 2002. Came close in 2007 and 2008 as well. Rampant spending is what has always caused the deficits to occur. Spending more than you make/bring in is a bad idea. Both sides have contributed to the excessive spending.Link? \

However, from about 1935 to 1980 the top tax rate was 74% to 91%. Reducing that is why we have a debt of 30 something trillion.

Nothing to do with spending, huh?Link? \

However, from about 1935 to 1980 the top tax rate was 74% to 91%. Reducing that is why we have a debt of 30 something trillion.

Is it wrong to hope he goes tits up before he gets that done?They controlled the

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

www.forbes.com

www.forbes.com

Why do people get so worked up about the capital gains tax? I used to feel the same way, but then it occurred to me, it's the biggest deceit there is. We tolerate the fact that 40 to 50% of our wages are taxed, but that's just our wealth. It's taxed at a MUCH higher rate, but no one is up in arms about that, but oh my God, we can't possibly tolerate the fact that our stocks get taxed at a 25% rate? In what universe does it make sense to punish people for working more than you punish people for investing? Personally, I wouldn't treat either of them differently, both are wealth at the end of the day, but particularly in today's age, when we have trouble getting people to work, why are you going to punish people for working? Please explain.They controlled the

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

Absolute BS. When that rate was in effect, there were a million deductions and exemptions in effect, so while the rate has fallen, most of those deductions and exemptions have been eliminated or heavily scaled back. That rate was never the actual rate for anyone who had a clue. You would have to be the dumbest person alive to ever pay that rate then, which no one did.Link? \

However, from about 1935 to 1980 the top tax rate was 74% to 91%. Reducing that is why we have a debt of 30 something trillion.

Our wages are not taxed at 40-50% and capital gains rate does not apply to just stocks. Most people do not have pensions and must save for retirement by investing. It’s already harder than ever for people to retire. Why bleed them dry?Why do people get so worked up about the capital gains tax? I used to feel the same way, but then it occurred to me, it's the biggest deceit there is. We tolerate the fact that 40 to 50% of our wages are taxed, but that's just our wealth. It's taxed at a MUCH higher rate, but no one is up in arms about that, but oh my God, we can't possibly tolerate the fact that our stocks get taxed at a 25% rate? In what universe does it make sense to punish people for working more than you punish people for investing? Personally, I wouldn't treat either of them differently, both are wealth at the end of the day, but particularly in today's age, when we have trouble getting people to work, why are you going to punish people for working? Please explain.

I agree that we don't need to bleed the "everyday" taxpayer who is looking to retire.It’s already harder than ever for people to retire. Why bleed them dry?

Your transition from conservative Republican to tax-and-spend Democrat/Marxist is nearing completion.I agree that we don't need to bleed the "everyday" taxpayer who is looking to retire.

The proposal outlined in this thread applies to folks with BOTH taxable income over $1,000,000, and capital gains over $400,000 annually.

My guess is they'll be able to get by with the proposed increase.

A small increase in taxes for the 0.001% doesn't seem too far out of reach given our current deficits.Your transition from conservative Republican to tax-and-spend Democrat/Marxist is nearing completion.

Your numbers are all boogered up. The top LT capital gains rate is currently 20%. If you’re speaking of ST capital gains rates you should specify that. A 1.2% increase in the 37% top ST capital gains rate doesn’t approach 44.6%.You do realize that the proposal is to increase the top tax rate for those making over $1,000,000 to 39.6%, and a 1.2% increase in the capital gains rate would increase the capital gains rate to the 44.6% rate. The proposal only applies to folks with taxable incomes over $1,000,000 and capital gains over $400,000.

If this affects you, my congratulations.

My guess is you guys knew this, but bitching about it fit your narrative.

Biden Capital Gains Rate Proposal: 44.6%?

The number being bandied about is 44.6%, which would be the highest formal federal capital gains rate since its inception.www.forbes.com

Because cap gains are a result of already taxed dollars being put at risk / invested. When you tax the hell out of them you discourage the very activity that makes capitalism work.Why do people get so worked up about the capital gains tax? I used to feel the same way, but then it occurred to me, it's the biggest deceit there is. We tolerate the fact that 40 to 50% of our wages are taxed, but that's just our wealth. It's taxed at a MUCH higher rate, but no one is up in arms about that, but oh my God, we can't possibly tolerate the fact that our stocks get taxed at a 25% rate? In what universe does it make sense to punish people for working more than you punish people for investing? Personally, I wouldn't treat either of them differently, both are wealth at the end of the day, but particularly in today's age, when we have trouble getting people to work, why are you going to punish people for working? Please explain.

Investing in the stock market would stop completely. Why take the risk you could lose money on a stock when they take half of any profit you make. There would be no reason. Home sales would stop unless someone had to move. Sale of one’s business would stop. It would be the end of our current economy. No matter what side you vote for, this is just logic. It seems the Dems have never taken an economics class or have any little bit of common sense. Perhaps when many in the government have never run their own business or had to make payroll and they have lived off the government teet their entire life they cannot understand the economy. They would sell it as a way to get the rich but most people have retirement accounts or a home sale etc that would get hit with capital gains.They controlled the

White House

The Senate AND

The house.

Biden want to raise the capital gains tax to 45%

And many then stopped working when their income approached those levels. Investment in the market was a tiny fraction of what it is today. If you had a job and knew if I work harder and make 100,000 more but the government keeps 90,000 or I just take many months off instead to key my income level down what would you do? It kills the work ethic.Link? \

However, from about 1935 to 1980 the top tax rate was 74% to 91%. Reducing that is why we have a debt of 30 something trillion.

They might claim they will only do it to those making those incomes. But …. Just like Joe said I won’t increase taxes on anyone making less than 200,000. We won’t audit anyone making less than that amount either. But data shows the irs audits will primarily hit those who make under 200k and many who make less than 70k. The problem our government has is SPENDING not a lack of revenue. As long as we have a deficit ALL money going to other countries should stop completely. China does not give away billions to every country on the planet but we do. If you declare bankruptcy and are broke, you don’t borrow money and turn around and give it all away and then say oh I need to borrow more. But that is what our government does. We need term limits, literacy tests on economics etc for everyone in both houses and the cabinet. And every spending bill should get an individual up or down vote. No pork garbage projects. If that was all done we could balance the budget. Tax revenues go up with tax cuts. But again it’s not the revenue it is the ridiculous spending. The nation needs to be run like a large corporation who answers to their stockholders which in this case is the citizens.You do realize that the proposal is to increase the top tax rate for those making over $1,000,000 to 39.6%, and a 1.2% increase in the capital gains rate would increase the capital gains rate to the 44.6% rate. The proposal only applies to folks with taxable incomes over $1,000,000 and capital gains over $400,000.

If this affects you, my congratulations.

My guess is you guys knew this, but bitching about it fit your narrative.

Biden Capital Gains Rate Proposal: 44.6%?

The number being bandied about is 44.6%, which would be the highest formal federal capital gains rate since its inception.www.forbes.com

You are wrong because all they will do is waste more money and realize we need to tax more people. It won’t stop there. It never does. And even that would negatively impact the stock market and economy. There would be a massive dump of investments by people in that category all at once before the law was passed leading to a collapse of the market.I agree that we don't need to bleed the "everyday" taxpayer who is looking to retire.

The proposal outlined in this thread applies to folks with BOTH taxable income over $1,000,000, and capital gains over $400,000 annually.

My guess is they'll be able to get by with the proposed increase.

The gains themselves are just money that has never been taxed, just like someone's wages. Both are simply different forms of currency. If I earn through income 500 K this year, I'm going to lose half of that to taxes, and that $$ could also be used for investment if it wasn't going to the tax collector. Why should it be disfavored as potential capital relative to someone's stock gains?Because cap gains are a result of already taxed dollars being put at risk / invested. When you tax the hell out of them you discourage the very activity that makes capitalism work.

I think he meant marginal rate vs actual rate.I have no idea what youre talking about. If your wages are getting taxed at 45% , you need to call HR or your accountant or something. Im a single guy , file as Head of Household and Im at @ 28%.

I believe Joe...just like Obama - you can keep you healthcare if you like it. They want all of our money they can take.They might claim they will only do it to those making those incomes. But …. Just like Joe said I won’t increase taxes on anyone making less than 200,000. We won’t audit anyone making less than that amount either. But data shows the irs audits will primarily hit those who make under 200k and many who make less than 70k. The problem our government has is SPENDING not a lack of revenue. As long as we have a deficit ALL money going to other countries should stop completely. China does not give away billions to every country on the planet but we do. If you declare bankruptcy and are broke, you don’t borrow money and turn around and give it all away and then say oh I need to borrow more. But that is what our government does. We need term limits, literacy tests on economics etc for everyone in both houses and the cabinet. And every spending bill should get an individual up or down vote. No pork garbage projects. If that was all done we could balance the budget. Tax revenues go up with tax cuts. But again it’s not the revenue it is the ridiculous spending. The nation needs to be run like a large corporation who answers to their stockholders which in this case is the citizens.

Oh god, one of those. Listen, NOBODY paid 70 to 90 per cent in taxes. There were thousands of deductions. My boss used to deduct three times what he made on his investment ($15 grand) from what he owed, on the bottom line because he invested in a military plane that flew in the Arctic. He was an ex-army colonel, very proud of that. He used to tell (brag to) us every year.Link? \

However, from about 1935 to 1980 the top tax rate was 74% to 91%. Reducing that is why we have a debt of 30 something trillion.

Got it , thank you.I think he meant marginal rate vs actual rate.

Fed at 28%, plus 6% state, plus 7.65% for the employee portion of FICA puts one at 41.65%, adding in the additional .9% in Obamas' Medicare tax if you make over $200,000 individually and you are at a marginal rate of 42.55%.

If that person is self employed, the FICA is 15.3% and that puts the total at 50.2%. If the person is self employed and making over $539,000 as an individual, their Federal margin is at 37% and well over 50% total.

OR- it could be the non stop spending thats happened over the last 30 years?Link? \

However, from about 1935 to 1980 the top tax rate was 74% to 91%. Reducing that is why we have a debt of 30 something trillion.

HW Bush had it right when he called trickle done tax policies voodoo economics. We’ve had thirty years to show that supply side economics doesn’t work and in fact there is limited to no wealth trickling down.I agree that we don't need to bleed the "everyday" taxpayer who is looking to retire.

The proposal outlined in this thread applies to folks with BOTH taxable income over $1,000,000, and capital gains over $400,000 annually.

My guess is they'll be able to get by with the proposed increase.

of course not......and the current Prez has nothing to do with inflation or high gas prices.Nothing to do with spending, huh?

That’s why I do an LLC - S corp. my goodness I was paying so much on taxes when I was self employed (sole proprietor) Not even funny.I think he meant marginal rate vs actual rate.

Fed at 28%, plus 6% state, plus 7.65% for the employee portion of FICA puts one at 41.65%, adding in the additional .9% in Obamas' Medicare tax if you make over $200,000 individually and you are at a marginal rate of 42.55%.

If that person is self employed, the FICA is 15.3% and that puts the total at 50.2%. If the person is self employed and making over $539,000 as an individual, their Federal margin is at 37% and well over 50% total.

But those gains could have been losses. You have to provide incentive to start businesses and inject capital into the economy. The dollars invested were taxed when they were earned.The gains themselves are just money that has never been taxed, just like someone's wages. Both are simply different forms of currency. If I earn through income 500 K this year, I'm going to lose half of that to taxes, and that $$ could also be used for investment if it wasn't going to the tax collector. Why should it be disfavored as potential capital relative to someone's stock gains?

My income could be lost if I ever received it. That's a circular argument.But those gains could have been losses. You have to provide incentive to start businesses and inject capital into the economy. The dollars invested were taxed when they were earned.

Because that money earned has already been taxed.My income could be lost if I ever received it. That's a circular argument.

If I didn't lose $200k in taxes, that money could be used as capital. It isn't because the government takes it on the front end. Why does it matter whether my $200k gain comes from my labor or passive contributions from a prior investment? It's all money. Why disfavor working at a higher rate?

The US has the biggest group of suckers in the universe. People who sign up to be treated like Warren Buffett and defend every tax structure in existence to defend his ilk when the system is literally designed to ensure that the vast majority of the tax revenue will be taken from those who receive income rather than the holy sacred "gains."

And I'm the opposite of an anti-capitalist, but I don't enjoy "Capitalist Theater" where we pretend like our tax code hasn't been manipulated to protect certain classes of shareholders from the policies they claim to endorse. Folks like Buffett love to talk about how they support higher taxes and should be held to a higher standard, but weirdly, they aren't, and the reason is we have a bunch of suckers whose wealth increases by increments of $100k to $500k per year through working who feel some sort of weird solidarity with people who make far more from investment income and who pay a considerably lower rate when their annual wealth goes up by much larger increments.

Yeah I can remember John Kerry was paying about 15% in taxes when he tried running for office. If you marry a billionaire heir to Heinz, you can live off of tax free bonds and stock dividends. Same for Buffett.My income could be lost if I ever received it. That's a circular argument.

If I didn't lose $200k in taxes, that money could be used as capital. It isn't because the government takes it on the front end. Why does it matter whether my $200k gain comes from my labor or passive contributions from a prior investment? It's all money. Why disfavor working at a higher rate?

The US has the biggest group of suckers in the universe. People who sign up to be treated like Warren Buffett and defend every tax structure in existence to defend his ilk when the system is literally designed to ensure that the vast majority of the tax revenue will be taken from those who receive income rather than the holy sacred "gains."

And I'm the opposite of an anti-capitalist, but I don't enjoy "Capitalist Theater" where we pretend like our tax code hasn't been manipulated to protect certain classes of shareholders from the policies they claim to endorse. Folks like Buffett love to talk about how they support higher taxes and should be held to a higher standard, but weirdly, they aren't, and the reason is we have a bunch of suckers whose wealth increases by increments of $100k to $500k per year through working who feel some sort of weird solidarity with people who make far more from investment income and who pay a considerably lower rate when their annual wealth goes up by much larger increments.

Exactly. The old adage that if you want less of an activity, tax it applies here. So, if you want me to invest 1 mil to create 10 new jobs at my company, make it easier for me to make a decent ROI. In doing so, the 10 new income tax payers will offset any gain I make by putting my money at risk rather than safely sitting on the capital.Because cap gains are a result of already taxed dollars being put at risk / invested. When you tax the hell out of them you discourage the very activity that makes capitalism work.

FICA is nothing more than taxes employees pay that are hidden in the form of an employer contribution. So everyone making under the threshold is really saddled with nearly 16% right off the top.I think he meant marginal rate vs actual rate.

Fed at 28%, plus 6% state, plus 7.65% for the employee portion of FICA puts one at 41.65%, adding in the additional .9% in Obamas' Medicare tax if you make over $200,000 individually and you are at a marginal rate of 42.55%.

If that person is self employed, the FICA is 15.3% and that puts the total at 50.2%. If the person is self employed and making over $539,000 as an individual, their Federal margin is at 37% and well over 50% total.

Retirement accounts are taxed as ordinary income nit capital gains. Home sale gain is excluded $500,000 gain. So if you paid $100,000 for your home and sell it for $600,000 there is no tax.Investing in the stock market would stop completely. Why take the risk you could lose money on a stock when they take half of any profit you make. There would be no reason. Home sales would stop unless someone had to move. Sale of one’s business would stop. It would be the end of our current economy. No matter what side you vote for, this is just logic. It seems the Dems have never taken an economics class or have any little bit of common sense. Perhaps when many in the government have never run their own business or had to make payroll and they have lived off the government teet their entire life they cannot understand the economy. They would sell it as a way to get the rich but most people have retirement accounts or a home sale etc that would get hit with capital gains.

Retirement accounts are taxed as ordinary income nit capital gains. Home sale gain is excluded $500,000 gain. So if you paid $100,000 for your home and sell it for $600,000 there is no tax.

What exactly do you want to cut? Don't just say waste etc.Nothing to do with spending, huh?

Everything until the government spending is equal to or less than its inflows. Kind of like how ordinary Americans have to do it. And do it without the damned democrats solution to everything: more taxes.What exactly do you want to cut? Don't just say waste etc.

yes, but only because Kamala would become President. She is worse than Joe blow. 😵💫🫣Is it wrong to hope he goes tits up before he gets that done?

Yeah these politicians love to talk about “fair share”. Wonder what Joe paid on his 10%? Not even going to talk about those so-called $200K loan repayments………..but they love playing class warfare.Because that money earned has already been taxed.

Scenario A: You earn $500k. The last $100k is taxed at the highest rate - 40%. You've netted $60k on that $100k. Now you can invest that $60k knowing that if you make gains on that investment, you'll keep 80% of those gains, as cap gains are taxed at 20%

Scenario B: You earn $500k. The last $100k is taxed at the highest rate - 40%. You've netted $60k on that $100k. Now you can invest that $60k knowing that if you make gains on that investment, you'll keep only 60% of those gains, as cap gains are taxed at 40%.

Why not just sit on your cash in scenario B, as the risk / reward dynamic sucks.

And with a nation of folks sitting on their cash, companies aren't started, innovation isn't happening, capital / liquidity flows into the market suck, etc, etc. It depresses growth and absolutely affects employment and the financial situation for the average american.

As someone who raises capital for real estate, I can tell you the ultimate taxation of any gains is a huge part in the "do I invest in this" equation. It is why there are huge capital flows into rental property (deferred taxes on rental income and cap gains on profits) versus build for sale product (taxed at ordinary income rates). It is why among other reasons foreign capital loves investing in the US, as the tax rules favor investing in US property versus most places internationally.

Doing things to stop the flow of investment capital in this Country is tantamount to shooting the economy point blank in the head. But politically, I guess it plays better to villify the "millionaires and billionaries" (side note - there is a massive difference in a million dollars versus a billion dollars). Villify the "fat cats" and the "big corporations". "Make them pay their fair share." Ignorance.